The recent alleged ‘media misinformation’ by Platt (McGraw Hill Financial) – an internet energy information source commonly regarded as highly trusted– left the twelve CARICOM countries signatory to PetroCaribe in uproar. Questions swirled about the new order, and the economic threats attached to energy insecurity became instantly evident. For the readers versed in Physics or for those MythBusters fanatics like myself, the science behind the concept of ‘dodging a bullet’ should be familiar – there exists a theoretical distance at which one can both see a bullet being fired and get out of the way before it hits. However, the closer the bullet is launched, the more the act of dodging moves from being probable to impossible. Understanding this theory, the mind begs – would the Caribbean countries signatory to PetroCaribe be able to ‘get out of the way’ before the devastating effects of energy insecurity and economic crisis become reality? More precisely, would the bullet of tightened PetroCaribe loan terms meet a strategically placed or an unprepared Caribbean?

To put the reality of this morass situation into perspective, two key variables must be recognized: Venezuela’s current deepening economic trouble and uncertainty, and the Caribbean’s long standing dependence on Venezuela for such a critical input.

Venezuela currently faces a crisis marked by rising inflation, shortages and slowing growth. Furthermore, the country’s energy reserves continue to decline. According to Reuters, when the late President Hugo Chávez was elected in 1998, Venezuela was producing 3.41 million barrels per day (bpd). More recent numbers (February 2013) suggest average bpd of just 2.34 million. Amidst this economic turmoil, political instability deepens as Opposition leader Henrique Capriles’ continues to tour Latin American countries to press his case that the election, which President Nicolás Maduro won by a margin of 1.5 percentage points, was fraudulent; a situation that has further fuelled tensions among Venezuelans. How does this affect these twelve CARICOM countries? Well… aside from some of Maduro’s supporters calling for an end to Petrocaribe, Capriles has vowed that under his administration Venezuela would no longer “give away” oil. His position is evidenced by his dominant advocacy during his 2012 campaign for an end to oil agreements with several countries – including Cuba, the Dominican Republic, and Jamaica – in order to finance a 40 percent increase in Venezuela’s minimum wage.

It must however be noted that the Caribbean’s reliance on Venezuela for energy did not begin in 2005 with PetroCaribe – this dependence can be traced back to the 1973 Latin American Energy Organization (OLADE), the 1985 Association of Petroleum Enterprises of Latin America (ARPEL), the 1980 San Jose Accord, and the 2000 Caracas Energy Agreement. Nonetheless, touted as ‘a shield against misery’, PetroCaribe has been responsible for circa USD 14 billion worth of oil distributed to countries in Latin America and the Caribbean.

PetroCaribe funding has allowed Jamaica to meet IMF obligations, and has assisted the former national airline Air Jamaica and the Sugar Company of Jamaica (SCJ); refinanced US$11 million in existing loans taken on by the Port Authority of Jamaica for its expansion of the Kingston Container Terminal; provided interim financing for Clarendon Alumina Production; refinanced a loan facility with PanCaribbean Financial Services; expanded the utility-scale Wigton Wind Farm; executed the Sandals Whitehouse project; provided on-lending to small and medium-size businesses in the productive sector; supported skills training and basic infrastructural work including the removal of pit latrines from schools; established a flood damage programme and supporting various other social projects such as “Lift up Jamaica”; and projects located in Kingston such as the Urban Transportation Centre in Half Way Tree. Since natural gas price differentials with Trinidad and Tobago remain unsettled, changes in PetroCaribe would truly leave the Jamaica Dollar under tremendous pressure. According to Jamaican Minister of State Julian Jay Robinson, “Without PetroCaribe, Jamaica would have to find an additional $500 million annually to pay for oil imports.”

In Dominica, PetroCaribe has facilitated the reduction of gasoline prices and the subsidization of the budget to the tune of more than EC$500 million a year. In Haiti, PetroCaribe funds have reduced blackouts and power shortages; paid for the construction of power stations and expanded electricity networks; improved airports, supplied garbage trucks, and supported widely-deployed Cuban medical teams. In line with his Socialist vision, President Chavez also forgave Haiti’s US $295 million PetroCaribe debt after the earthquake in 2010. In general, PetroCaribe has allowed countries to keep energy costs slightly lower than they would have otherwise been–a factor that was especially beneficial when oil prices topped US $140 per barrel in 2007.

Since the economic crisis began, Venezuela’s insertion in the energy industry of the Caribbean moved further from these social underpinnings. Venezuela’s state oil company PDVSA has invested in the construction and upgrading of refineries in Cuba, the Dominican Republic and Jamaica. In 2008 Venezuela purchased 49 per cent of the shares in Jamaica’s Petrojam Refinery, while in 2009 the country bought a similar 49 percent stake in the Dominican Republic’s state-run refinery company Refidomsa.

However, despite all these benefits brought by PetroCaribe, an underlying element of energy dependence and worsening energy security may in the long-term prove to be counter-productive. The Dominican Republic, already beset with financial troubles, owes Venezuela US$3.3 billion for its PetroCaribe deals only; while Jamaica owes roughly US$2.4 billion. Though financial management theory suggests that a portion of debt is good as debt is less risky than equity, carrying such a large amount of debt in the long run can cause economic failure, especially when related to reliance on a commodity as costly and unstable as oil.

Still, in spite of consistent threats (or some may say warnings), alternative means to securing future energy supplies have yet to be realized. Though efforts are underway in the Bahamas, Jamaica, Guyana and Suriname basin, and CARICOM energy ministers have recently agreed to adopt a regional energy policy and provisional targets for renewable energy over the long-term (both region-wide and in their respective countries); the region is still in no way prepared for a change in PetroCaribe terms.

In a report by Jamaica Information Service March 18th 2013 Dr. Wesley Hughes, Director of the PetroCaribe Development Fund, stated that the country owed a ‘debt of gratitude’ to President Hugo Chavez and by extent Venezuela. However, with Venezuelans unable to even purchase toilet paper due to shortages, these CARICOM countries just maybe forced to put a price to gratitude very soon.

So… Where to from here?

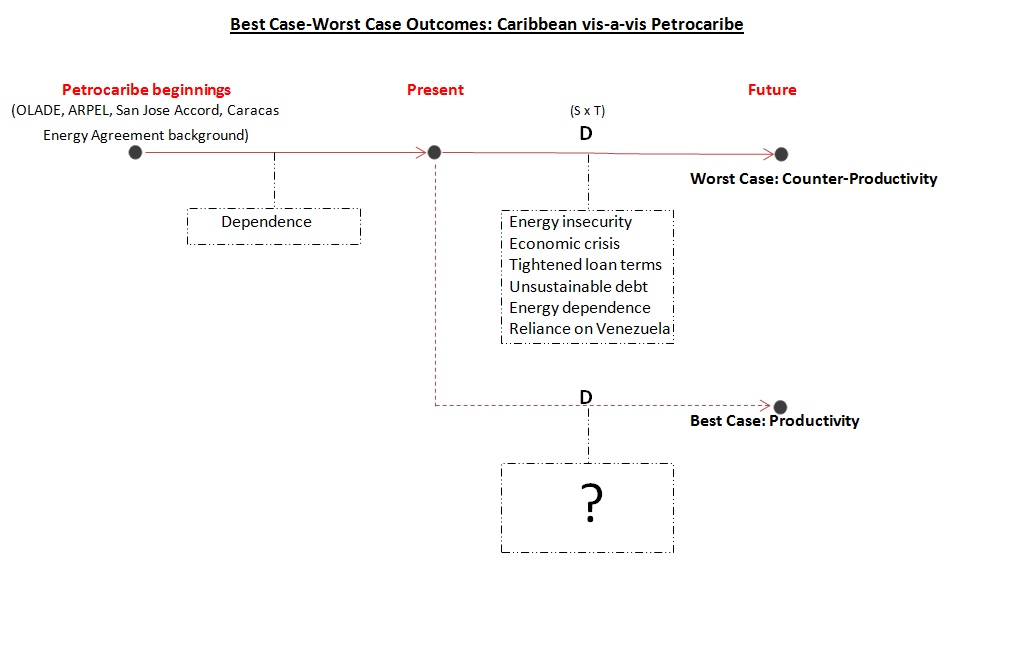

To put the discussion in perspective, a conceptual framework is presented below:

Assuming that the theoretical distance between a probable rise in PetroCaribe interest rates and the Caribbean energy industry is not close – i.e. the Caribbean (henceforth referring to only those signatory to PetroCaribe) is still in a position to implement strategic measures to improve energy security and show resilience against tightened PetroCaribe terms; the diagram above shows two possible outcomes for the Caribbean energy outlook. Recalling the critical position of both the Venezuelan and Caribbean economies and recognizing issues of past dependency, the Caribbean is at a point where its future sustainability can either be “counter-productive” (retracting all the benefits PetroCaribe has granted) or “productive”.

Therefore, how does the Caribbean move from the present to a productive future? Though there are no one-size-fits-all measures, practices that reduce debt, sustainably manage future debt and other obligations, improve energy security and reduce exogenous effects due to reliance are key.

Where debt is concerned, tax increases, budget cuts and escalated printing of money have commonly been used as adrenaline shots. However, as seen in Germany after the First World War, such actions can cause the currency to become worthless and also increase the rate of inflation if the economy is not growing relative to the rate of printing. As a result, for long-term debt improvements, reducing brain drain, enhancing dialogue between government, civil society and business, increasing opportunities for Small and Medium Enterprises, diversification of the economy, increasing innovation within creative industries, and expanding intellectual property value capture (e.g. Jamaican art forms and sports and Antigua and Barbuda black pineapple) are essential. These practices must however coordinate with sound financial management in order to manage future liabilities.

Regarding energy security, diversification of supply sources and transportation routes, reinforcement of measures supporting ‘strategic’ stocks, and continuous investigation of possibilities for improving the security of gas supply and electricity supply are vital to any effective energy security policy. In the Caribbean this can be accomplished by harnessing the region’s alternative energy and logistical potential, producing backward and forward linkages within the industry, local content participation and development, developing energy services, engaging thorough and consistent research and development, ensuring transparency and good governance, and employing stabilization funds. Implementation of these measures can provide positive externalities to other sectors such as tourism and education services, also reducing reliance and vulnerability to exogenous effects.

It is important to note however that these measures must effectively and strategically coordinate with other policies and practices in order to be successful and prevent a Caribbean economic crisis. Nonetheless, given that quantum theory dictates that distance is a product of speed and time, the Caribbean must now implement these strategies in a rapid and timely manner, in order to increase the likelihood of a sustainable future.

_________

Related Point of Interest: The 8th PetroCaribe Summit on Jun 29th 2013, which also saw the proposal of an economic zone between PetroCaribe and the Bolivarian Alliance for the Peoples of Our America (ALBA), was spent discussing economic integration and tackling regional problems as a collaborative effort – particularly issues of transport and communication, productive chains, tourism, trade, and social and cultural integration. Since Barbados and Trinidad and Tobago are party to neither PetroCaribe nor ALBA, how does this affect CARICOM’s own regional effort?

Ralph B

Well written overview and summation of the forces at play within the energy crisis (yes I think we can call it crisis) in the Caribbean. We are working hard at introducing renewable energy solutions across the region and hopefully they will open their minds before the pumps run dry. Change is the most difficult obstacle to overcome in the minds of the people here. In the meantime, let’s get technology working for us to eliminate all the wasted driving. I was forced to drive my car into town 4 times to process an application that could have been accomplished online from home in a few minutes.

Khadija Holder

Thank you for your feedback Ralph. What you highlighted is the thing that scares me. While energy security implementation may eventually be discussed when notice of ‘the pump running dry’ proliferates; as evident by your experience, there is much bureaucracy and banter causing a tremendous deficit between research and problem identification and implementation and monitoring. Waiting that long to take action leaves our region again playing ‘catch-up’ in a world that is not going to wait or continue to give special treatment based on size. Sadly, while dependence on oil continues in the Caribbean, developed countries continue to make advances in engine technology, mass transit systems and horsepower engines – further widening the gap between developed and developing. Therefore, simple inefficiency reduction strategies like this can indeed make a difference!

Leana

Certainly that seems to be a overarching problem with Caribbean policy makers…waiting until the very last minute…and then we get grazed by that proverbial bullet and wonder why us and how come. African nations have already formed the Africa Renewable Energy and Access Program (AFREA) and are looking into alternative energy. Many African universities engineering and environmental programs have received grants from international organizations and businesses to look into and develop proposed solutions. Google will be investing close to US$12 million into the Jasper Power Project in Northern Cape …Jasper is expected to be one of the largest and most productive solar installations.

After 30 years of generosity from Venezuela… I mean countries have huge amounts outstanding to Venezuela which if paid could be put towards the benefit of Venezuelan people, Caribbean nationals and their governments have not had to feel as much the grasping hand of the tragic oil increases over the years and we still expect oil prices of 30 years ago.??

You are completely right there needs to be a move towards energy security and alternative energy now. This is a prime time for carbon credits, energy alternatives and innovation and the Caribbean needs to get on that ASAP…or else we will end up with a botched last minute energy action that fails to be in sync with the policies and practices of Caribbean people and their governments.